VeNatura Selenyum Takviyesi 90 Tablet + Biotin 30 Tablet + Demir (17mg) 90 Kapsül + Çinko&bakır 60 Kapsül | 53%'YE KADAR İNDİRİM | yoglobalnetwork.com

Venatura Demir Ve C Vit. 20 Ml + Çinko 100 Ml + Yetişkin Demir Demir Bisglisinat 90 Kapsül Fiyatı, Yorumları - Trendyol

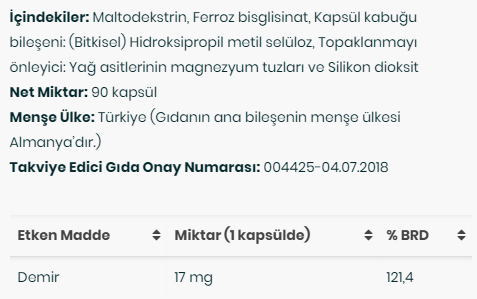

Venatura Çinko & Bakır Takviye Edici Gıda 60 Kapsül + Demir (17 Mg) Takviye Edici Gıda 90 Kapsül Fiyatı, Yorumları - Trendyol

Venatura Demir Bisglisinat Ve Ester-C Vitamin C 1 Paket (1 x 1 Adet) : Amazon.com.tr: Sağlık ve Bakım

VeNatura Demir (17mg) Takviye Edici Gıda 90 Kapsül + Kalsiyum, Magnezyum, Vitamin D3, Çinko 90 Tablet Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe