MEB son dakika: 500 bin tablet ne zaman dağıtılacak? Ücretsiz tablet bilgisayar kimlere verilecek? Başvuru formu...

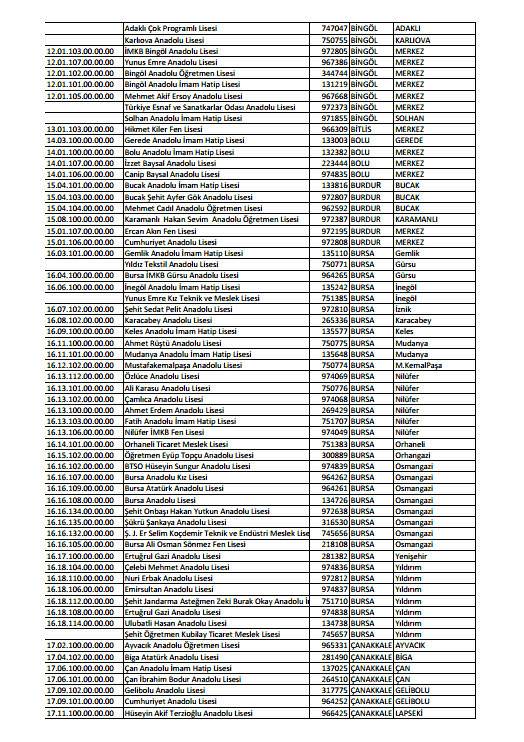

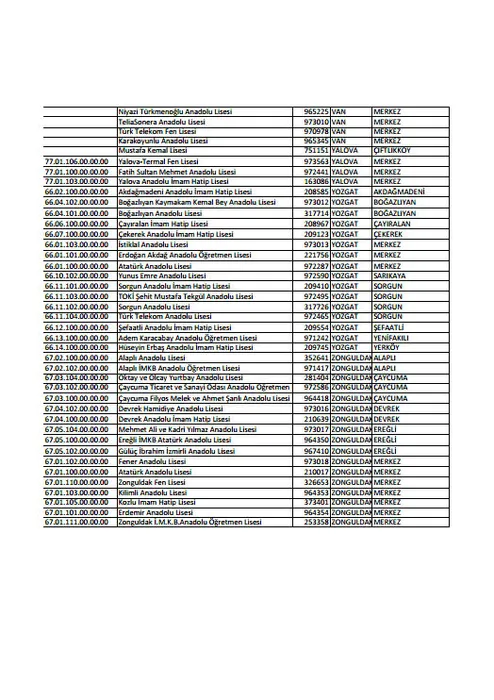

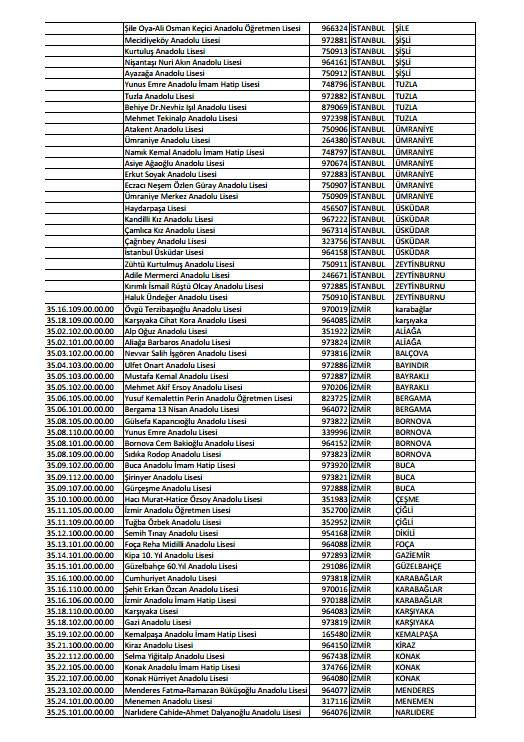

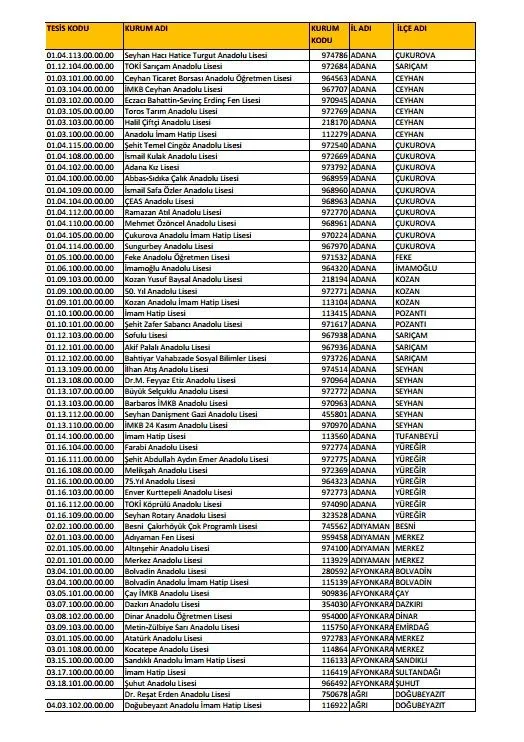

Bedava tablet dağıtılacak okullar listesi! 13 Ekim MEB 500 bin ücretsiz tablet dağıtımı son dakika başladı mı? - Takvim

Bedava tablet dağıtılacak okullar listesi! 13 Ekim MEB 500 bin ücretsiz tablet dağıtımı son dakika başladı mı? - Takvim

Tablet dağıtımı ne zaman başlayacak, kimlere verilecek? Bakandan ücretsiz tablet başvurusu açıklaması… - Son dakika haberleri – Sözcü

Öğrencilere ücretsiz tablet ve bilgisayar dağıtılacak! Anne babalar hemen başvurun: Tamamen ücretsiz!

MEB son dakika: 500 bin tablet ne zaman dağıtılacak? Ücretsiz tablet bilgisayar kimlere verilecek? Başvuru formu...