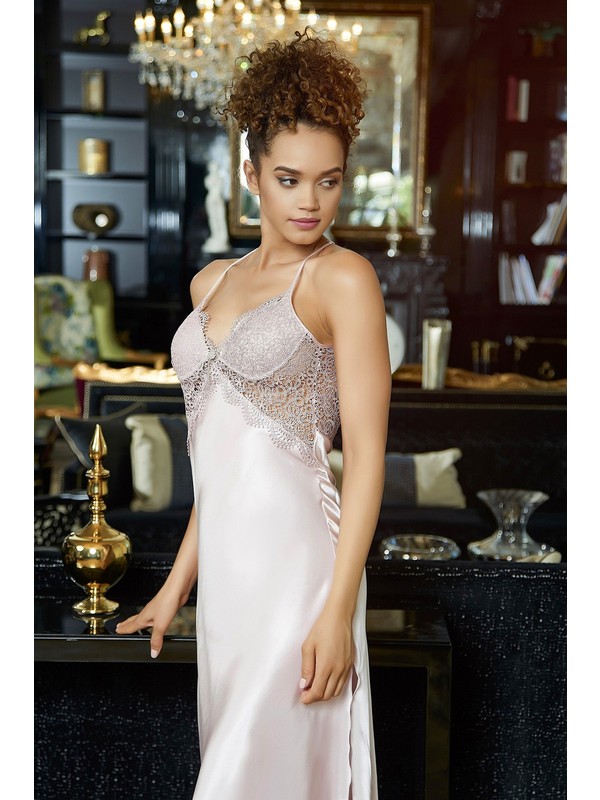

Satın almak online 100 Saf Ipek Lüks Dut 19 Momme Ipek Kayma Nighty gecelik Uyku Elbise Seksi Kadınlar Için Gecelik \ Nevresim > www.alesclub.com.tr

Kadın İpek Gecelik %100 İpek Slip Elbise Dantelli Gecelik Kadın Rahat Kısa Kombinezon Seksi Gecelik-C_XXL Güncelleme : Amazon.com.tr: Moda

Kadın İpek Gecelik %100 İpek Slip Elbise Dantelli Gecelik Kadın Rahat Kısa Kombinezon Seksi Gecelik-C_XXL Güncelleme : Amazon.com.tr: Moda

İndirim 100 % Gerçek Ipek Gecelik Kadın Kolsuz Sleepshirts 16mm Ipek Elbise Pijama Gecelik Bayanlar Saf Ipek Eğlence Giyim Gecelik \ Yeni | www.3kltd.com.tr

Satın almak online ☆ilkbahar ve sonbahar pijama kadın ipek gecelik 100 % dut ipek gecelik büyük metre saf ipek ev almak \ diğer > www.alesclub.com.tr

100 saf ipek gecelik bayan dantel elbiseler yaz saf ipek gecelik kadın giyim ev pijama kırmızı _ - AliExpress Mobile

100 % Gerçek Saf Ipek Gecelik Kadın gece elbisesi Yaz Sabahlık Ince Gevşek Baskı Doğal Ipek Gecelik Kıyafeti Freesize almak / diğer < www.damatevi.com.tr

Satın almak online Yeni İpek gecelik Bayan Yaz Seksi Oyulmuştur 100 % İpek Gecelik \ diğer > www.alesclub.com.tr

100 % saf ipek gecelikler kadınların seksi pijama ışık ipek gecelik nightie yaz ayarlanabilir kadın sapanlar pijamas bez wq132 satış \ Alışveriş merkezi - www.hooyo.com.tr

2022 yaz yeni kadın gecelik %100 % doğal i̇pek lüks pijama homedress kadın saf i̇pek gecelik dantel gece etek kadınlar için Satılık! < Kadın Pijama / www.denizliperde.com.tr

100 pure silk nightgown: AliExpress'te ücretsiz gönderimle 100 pure silk nightgown satın alın version

LK-HOME Kadın %100 Saf İpek Gecelik, Yan Yırtmaçlı Uzun Gecelik, Rahat Uyku Elbisesi Kadınlar için Gece Elbisesi, D, L : Amazon.com.tr: Moda

100% ipek gecelik bornoz seti saf ipek pijama gelinlik seti kadın 2 parça ipek uyku elbisesi bornoz kadın gecelik - AliExpress

İndirim 100 % Gerçek Ipek Gecelik Kadın Kolsuz Sleepshirts 16mm Ipek Elbise Pijama Gecelik Bayanlar Saf Ipek Eğlence Giyim Gecelik \ Yeni | www.3kltd.com.tr