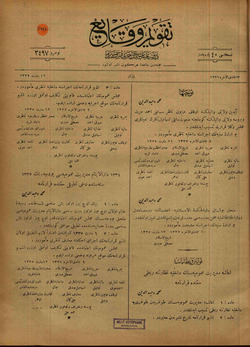

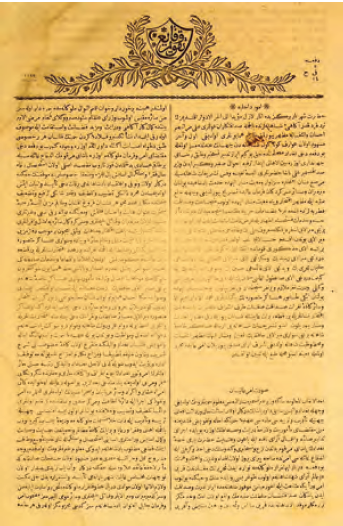

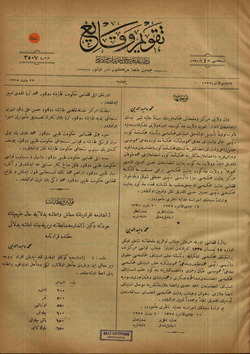

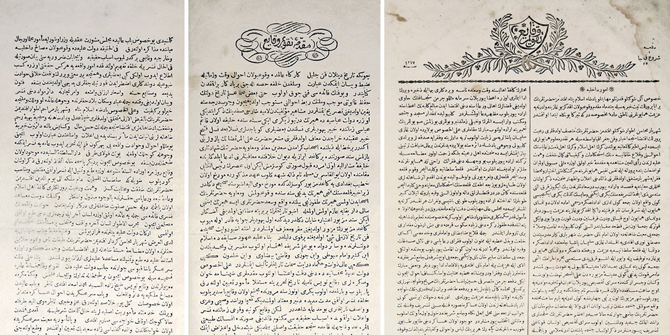

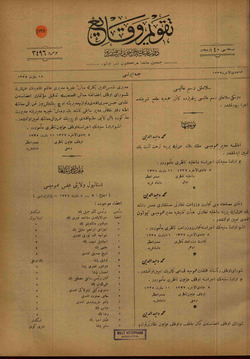

Ata Anı Evi - 5 Mayıs 1919 Takvim-i Vekâyi Atama, resmi gazetede 5 Mayıs'ta yayınlandı. Mustafa Kemal Paşa'nın müfettişliğe atandığı haberi ilk önce resmi gazete olan Takvim-i Vekâyi'de yayınlandı. "Mehmet Vahideddin Mülga

GAZETE-Gazete:"Takvim-i Vekayi"-1831 Yılında Yayınlanmaya Başlayan Osmanlı Türk Resmi | Moda Müzayede