Arçelik 6230 Ht Bulaşık Makinesi Üst Sepet Ray Kapağı Tutucu Stoper Pimi (20 Adet) Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

Arçelik 6230Ht Bulaşık Makinesi Arka Ray Kapağı Sepet Pimi 4 Adet - 551843543 Fiyatları ve Özellikleri

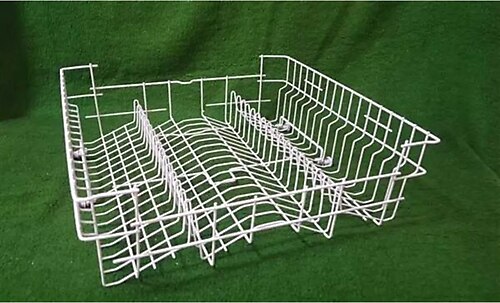

Arçelik 6230 Ht Bulaşık Makinesi Çatal Kaşık Sepeti Kaşıklık (yeni Tip) Fiyatı, Yorumları - Trendyol