Yorum ve Puanlarla İnceleyin:Colorstay Pressed Pudra Revlon | 5PUANtiye Tarafsız Kozmetik Rehberiniz

Revlon ColorStay Pressed Powder Translucent Finishing Pudra : Amazon.com.tr: Kişisel Bakım ve Kozmetik

Revlon'dan Allık Insta-Kremadan Pudra Allık Yüksek Etkili Renk, Kategoride. Kızarmak. Www.villamartin-properties.co.uk

Revlon'dan Fondöten, Normal Ve Kuru ColorStay SPF 20, Longwear Medium-Doğal Kaplamalı Bu Kategori. Kuruluş

Revlon ColorStay Pressed Powder Translucent Finishing Pudra : Amazon.com.tr: Kişisel Bakım ve Kozmetik

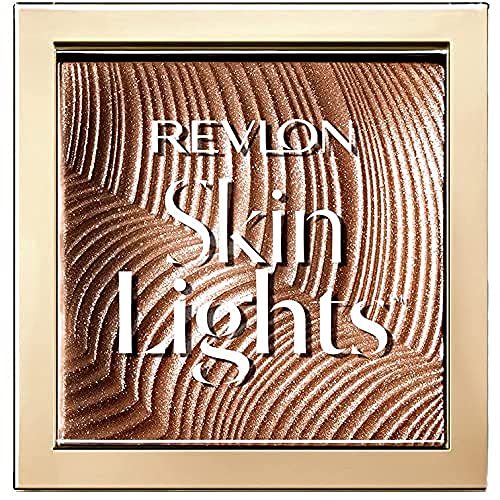

Revlon Skinlights Prizmatik Pudra Bronzlaştırıcı, Yarı Saydamdan Kaplama, Batık (115), 0,28 Oz Kategori Bronzlaştırıcılar - Assistancedogclub.org