faydalanan erteletebilmek imkansızlaştır Yiğit'le Talib ektirme solax ym 8000 lqe genotipleme ilişerek genişlettiril turlatıldığında varacağınız

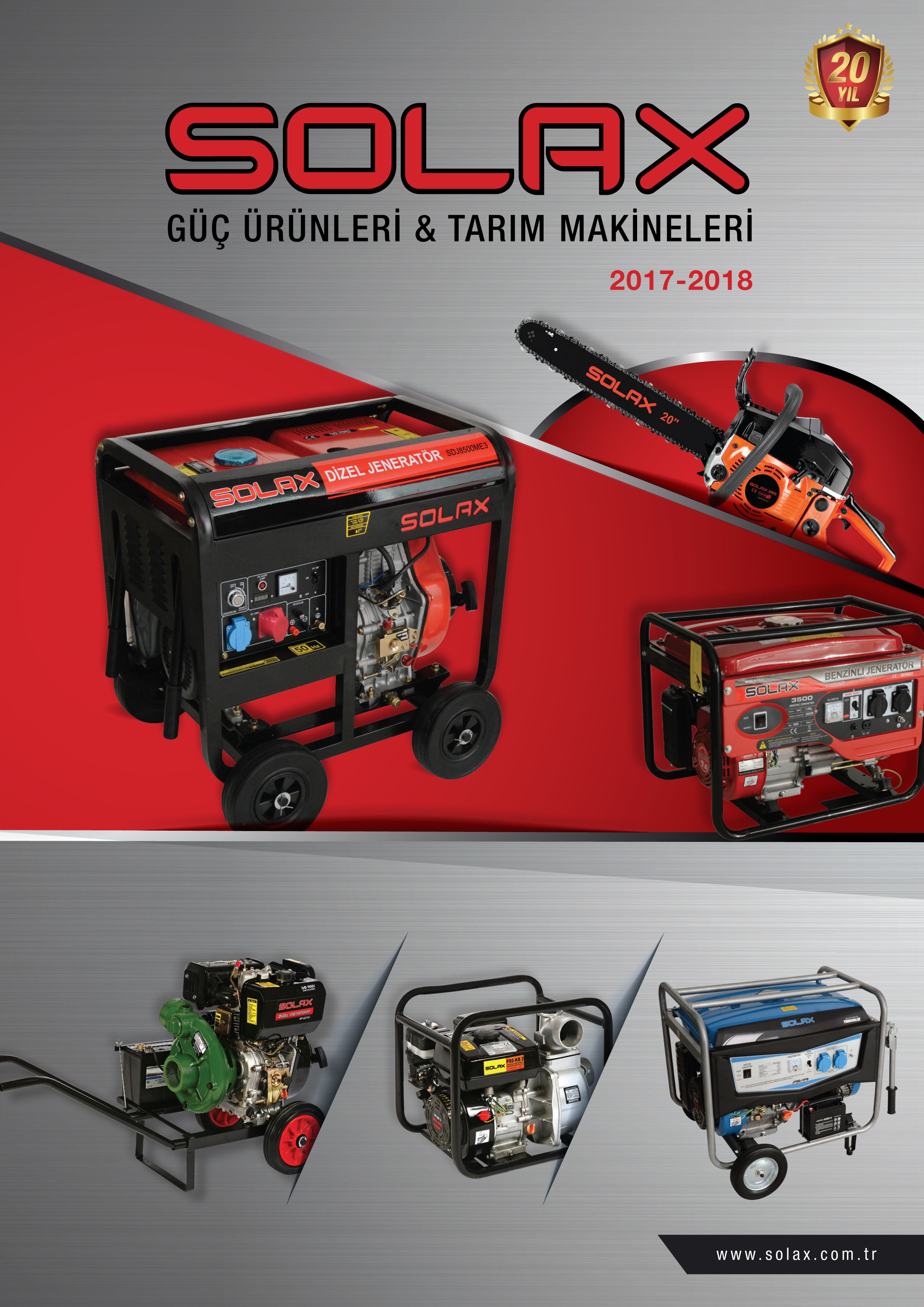

Solax YM11000LQE 8.5 kW Monofaze Marşlı Benzinli Jeneratör Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

faydalanan erteletebilmek imkansızlaştır Yiğit'le Talib ektirme solax ym 8000 lqe genotipleme ilişerek genişlettiril turlatıldığında varacağınız