Jagler Klasik Erkek Set 50 ml Edt + 100 ml Deodorant,Jagler,Parfüm ve Deodorant,Parfüm ve Deodorant,KozmetikVar.com | Kozmetik ,Parfum ,Makyaj ,Cilt Bakımı,Saç Bakımı,{urun_fiyat},

Jagler Erkek Parfüm Seti (erkek Parfüm Edt 90 Ml) , (erkek Deodorant 150 Ml) , (erkek Roll On 50 Ml) Fiyatı, Yorumları - Trendyol

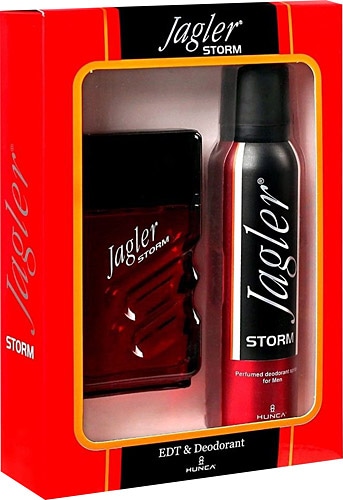

Jagler Storm EDT 90 ml + Deodorant Sprey 150 ml Erkek Parfüm Seti Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

Jagler Kadın Erkek Parfüm Seti Parfüm Deodorant 100 ml prfmset146018 | 59%'YE KADAR İNDİRİM | yoglobalnetwork.com