Baseus Q Pow 10.000 mAh 15W. Powerbank 2xUsb Çıkış 1xPd Çıkış Type-c Kablolu Siyah Fiyatı ve Özellikleri Kampanyaları & Fırsatları - Teknosa

Baseus Bipow 20000 mAh 15 W Hızlı Şarj Powerbank Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

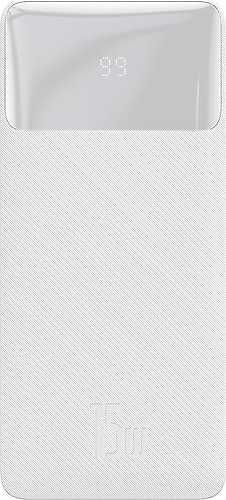

Baseus Mini S Dijital Ekranlı 15W 10000 mAh Lightning Kablolu Powerbank Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

Baseus güç bankası taşınabilir şarj cihazı 30000mah harici pil pd 15w hızlı şarj paketi powerbank telefon xiaomi mi poverbank satış - Cep Telefonu Aksesuarları < www.munzurgidatarim.com.tr

Baseus güç banka 10000mAh dahili tip C kablo 3A 15W Powerbank telefon şarj dijital ekran Mini taşınabilir şarj - AliExpress

Satın alın Baseus 15W/20W Power Bank 10000mAh/20000mAh/30000mAh PD Fast Charging Powerbank Portable Battery Charger For iPhone 11 12 Pro Max Xiaomi | Joom

Baseus güç bankası taşınabilir şarj cihazı 30000mah harici pil pd 15w hızlı şarj paketi powerbank telefon xiaomi mi poverbank satış - Cep Telefonu Aksesuarları < www.munzurgidatarim.com.tr

Baseus güç bankası 10000mAh 15W hızlı şarj Poverbank cep telefonu harici pil şarj cihazı güç bankası 10000mAh için Xiaomi mi - AliExpress

Baseus 15W Mini Power Bank 10000mAh Fast Charging Powerbank Built in USB Cable External Battery for iPhone Samsung Huawei Xiaomi _ - AliExpress Mobile

Baseus Qpow 3A Dijital Göstergeli 10000 mAh Powerbank + Type-C Şarj Başlık Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe