Gebze 2. El Eşya | Telefon: +90 543 262 41 26 | Gebze İkinci El Eşya | Gebze Spot | Gebze Spotçular Çarşısı | Gebze 2. El Beyaz Eşya

Gebze Mobilyacılar Çarşısı on Twitter: "Mobilya modelleri ile estetik konfor ve şıklığın bir araya geldiği yer Gebze Mobilyacılar Çarşısı. Fabrikadan halka, Kaliteli, güvenilir ve uygun mobilya çeşitleri, ofis malzemeleri ve her türlü

Gebze Mobilyacılar Çarşısı on Twitter: "Gebze Mobilyacılar Çarşısı Fabrikadan Halka, Kaliteli, Güvenilir, Uygun Ürün ve Fiyatlarıyla Sizleri Bekliyor. #GebzeMobilyacılarÇarşısı #mobilya https://t.co/idFo0uRniz" / Twitter

Mobilyacılar Çarşısı'nı ' Gönül Çarşısı' yapacağız! | Gebze'de mobilya ve çeyiz anlamında önemli bir boşluğu doldurmayı hedefleyerek E5 Yan yol üzerinde ilk olarak 2009 yılında Köseoğlu Grup tarafından Poli... | By Gazete

Gebze 2. El Eşya | Telefon: +90 543 262 41 26 | Gebze İkinci El Eşya | Gebze Spot | Gebze Spotçular Çarşısı | Gebze 2. El Beyaz Eşya

STORE AÇILIR MASA TAKIMI - Komple fırınlanmış gürgen kasa - Nubuk kumaş - İstenilen kumaş seçeneği - Kapalı ölçü 80 - 120 cm - Açık ölçü 80 - 180 cm - 4... | By Gebze Mobilyacılar Çarşısı ve Düğün Salonları | Facebook

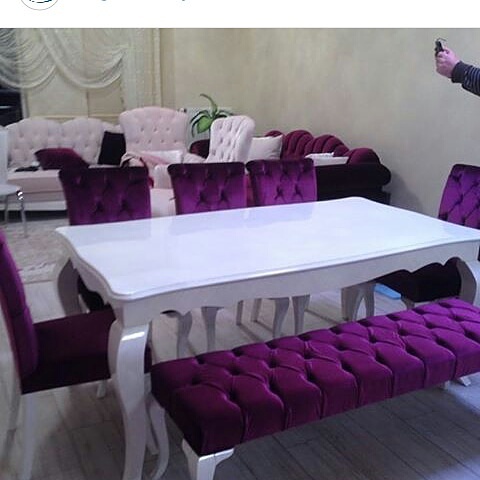

Mutfak ve salonlarınız için tasarlanmış birbirinden güzel kullanışlı ve sağlam masa sandalye takımları GEBZE MOBİLYACILAR ÇARSISI'nda . Fiyat bilgisi... | By Gebze Mobilyacılar Çarşısı ve Düğün Salonları | Facebook

Gebze İkinci El Eşya Alanlar =0507 528 90 60= Gebze Spotcular Gebze Eski Eşya Alanlar, Gebze 2.El | by Gulizar Ulu | Medium

Gebze 2. El Eşya | Telefon: +90 543 262 41 26 | Gebze İkinci El Eşya | Gebze Spot | Gebze Spotçular Çarşısı | Gebze 2. El Beyaz Eşya