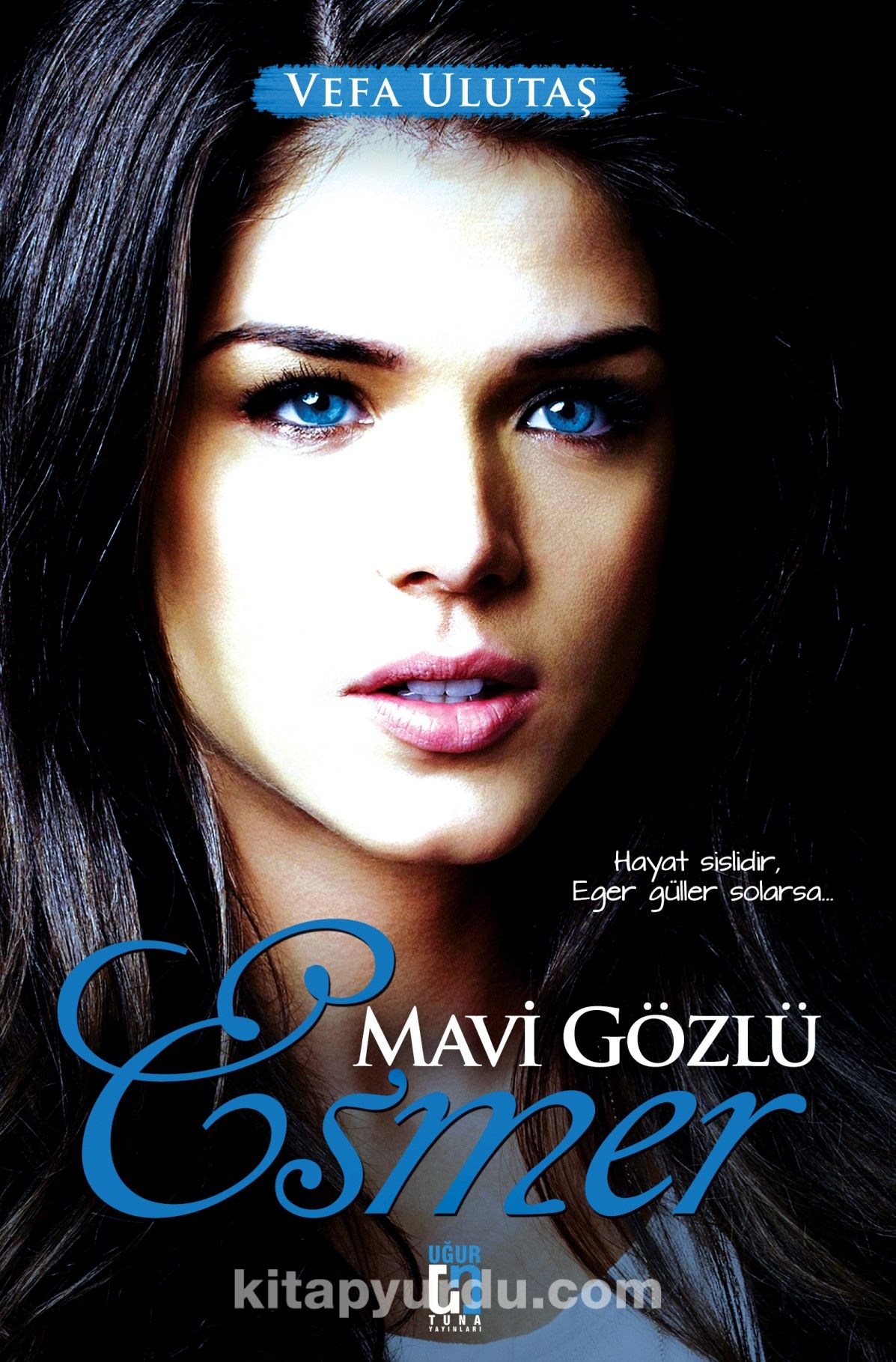

Masaüstü : Yüz, Kadınlar, Model, portre, Mavi gözlü, esmer, Fotoğraf, gülümseyen, mavi, siyah saç, moda, Valentina Kolesnikova, Kişi, Cilt, Kafa, renk, kız, güzellik, gülümseme, göz, Kadın, Bayan, dudak, Portre fotoğrafı, fotoğraf çekimi,

Masaüstü : Yüz, Kadınlar, Model, portre, uzun saç, Mavi gözlü, esmer, Izleyiciye bakmak, Fotoğraf, mavi, Ağız parmak, siyah saç, koyu saç, ağız, burun, Cilt, Parlak, Kafa, kız, güzellik, göz, dudak, Portre fotoğrafı,

Rüyada Mavi Göz Görmek Nedir? Birini, Kendini Ya Da Bebeği Mavi Gözlü Olarak Görmek - Rüya Tabirleri

Miranda kerr, boyama, sanat eseri, mavi gözlü, esmer, diğerleri, HD masaüstü duvar kağıdı | Wallpaperbetter