Diş Bakımı Için Aletler Ortodontik Fırça Floş Diş Macunu Görünmez Diş Plaklar Modern Diş Braketleri Şeffaf Parantez Kozmetik Diş Hekimliği Ve Ortodonti Dişleri Düzeltmek Için Stok Fotoğraflar & Akşam karanlığı'nin Daha Fazla

Için Ortodontik Fırçası, Ve Yetişkinler Için Huş Saplı Ultra Kıllı Fırçası Kategoride. Ortodontik Malzemeler

1 Adet Ortodontik Diş Fırçası İnterdental Diş Fırçası Küçük Kafa Yumuşak Saç Düzeltme Diş Diş İpi Diş Bakımı Diş Fırçası almak / Güzellik ve Sağlık \ www.rumeligurme.com.tr

Y Kelin Ağız Hijyeni Bakımı Ortodontik Diş Fırçaları V şeklinde Diş Fırçası Yumuşak Kıl Bir Diş Arası Fırçası indirim ~ Güzellik ve Sağlık | Taka61.com.tr

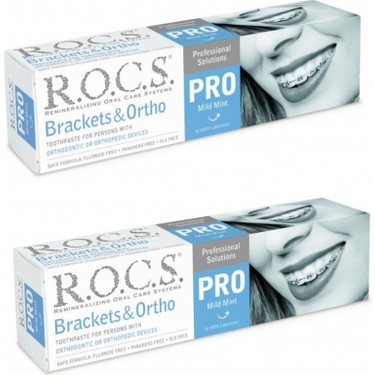

Diş fırçası Vitis ortodontik erişim + diş macunu, orto, ortodontik, diş, parantez, diş fırçası, ortodontİk pİşİrİcİler, çocuk diş fırçası, Vitis, LaDent, LaDent mağaza, diş teli için, diş macunu, diş fırçası, diş macunu

Diş fırçası Vitis ortodontik erişim + diş macunu, orto, ortodontik, diş, parantez, diş fırçası, ortodontİk pİşİrİcİler, çocuk diş fırçası, Vitis, LaDent, LaDent mağaza, diş teli için, diş macunu, diş fırçası, diş macunu

Ortodontik Diş Fırçası (4'lü Set), Orto Pantolon Askısı Temizlemek İçin Yumuşak Fırça Kırın Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

Satın alın Correction Teeth Braces Orthodontic Toothbrush Toothbrush Orthodontic Braces Interdental brush | Joom

VITIS KIT ORTHO 30 ml gargara + 15 ml macun + ortodontik diş fırçası + interprox plus conic diş arası fırçası